top of page

YA PUEDE VER CUANDO LLEGA SU REEMBOLSO ONLINE

PRESIONE EN UNO DE LOS BOTONES DE ABAJO

Reembolsos por estado

TASA DE IMPUESTOS 2013

Tasa de impuestos

2013 Tax Rates - Single Taxpayers - Standard Deduction $6,100

10% 0 to $8,925

15% $8,925 to $36,250

25% $36,250 to $87,850

28% $87,850 to $183,250

33% $183,250 to $398,350

35% $398,350 to $400,000

39.6% Over $400,000

2013 Tax Rates - Married Filing Separately - Standard Deduction $6,100

10% 0 to $8,925

15% $8,925 to $36,250

25% $36,250 to $73,200

28% $73,200 to $111,525

33% $111,525 to $199,175

35% $199,175 to $225,000

39.6% Over $225,000

2013 Tax Rates - Estates & Trusts

15% 0 to $2,450

25% $2,450 to $5,700

28% $5,700 to $8,750

33% $8,750 to $11,950

39.6% Over $11,950

2013 Tax Rates - Married Jointly & Surviving Spouses - Standard Deduction $12,200

10% 0 to $17,850

15% $17,850 to $72,500

25% $72,500 to $146,400

28% $146,400 to $223,050

33% $223,050 to $398,350

35% $398,350 to $450,000

39.6% Over $450,000

2013 Tax Rates - Head of Household - Standard Deduction $8,950

10% 0 to $12,750

15% $12,750 to $48,600

25% $48,600 to $125,450

28% $125,450 to $203,150

33% $203,150 to $398,350

35% $398,350 to $425,000

39.6% Over $425,000

Social Security 2013 Tax Rates

Social Security Tax Rate: Employers 6.2%

Social Security Tax Rate: Employees 6.2%

Social Security Tax Rate: Self-Employed 12.4%

Maximum Taxable Earnings $113,700

Medicare Base Salary Unlimited

Medicare Tax Rate 1.45%

Articulos Recientes

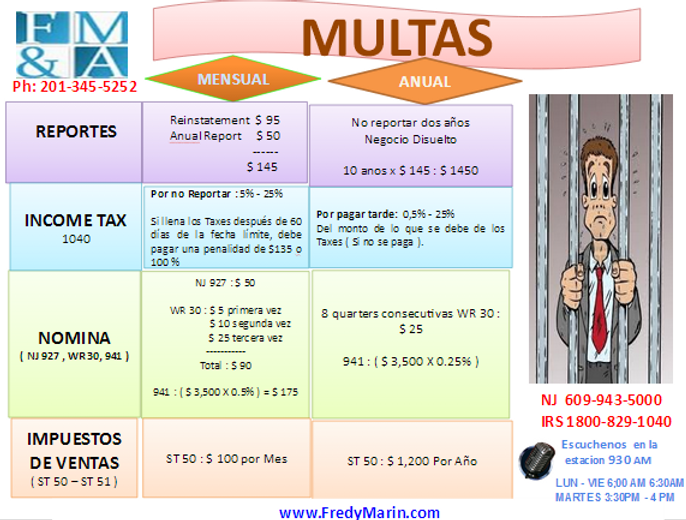

Multas

bottom of page